Market Overview -Week 06/24

2024-02-09

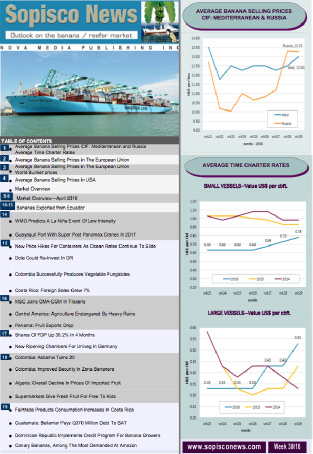

Banana selling prices in St. Petersburg were USD21.50-22.60 per box CIF according to brand, quality, and packing. Nearly 1.6 million boxes were discharged in week 6, and around 1.89 million are expected for week 7.

According to industry sources, there were around 300 FEUs with bananas at the St Petersburg port awaiting delivery by Friday, and more might pile up in the coming days due to the ban on 5 Ecuadorian banana exporting companies. Prices might increase due to the lower volumes of bananas available in the retail system. Prices in the Mediterranean for Ecuadorian bananas, depending on brand, volume, region, and packing, were USD 16.00-18.00 per box CIF. They were slightly higher in Libya, with Ecuadorian bananas sold at USD 17.00-18.00 per box CIF and bananas from Central America at around USD 16.00 per box CIF. Prices in the Mersin Free Zone were around USD 16.50-17.50 per box for the re-exported bananas of Ecuadorian origin.

In Algeria, prices improved compared to the previous weeks, when traders lost money, now they were able to make some profits, although non-relevant. The exchange rate was 1 USD=30.35 TL.

In February 2024, there was a significant change in the leadership of the Central Bank of the Republic of Türkiye (CBRT). Dr. Fatih Karahan, a Deputy Governor since July 28, 2023, was appointed as the new Governor of the CBRT1. His appointment followed the sudden resignation of his predecessor, Hafize Gaye Erkan, who had held the position for just eight months.

Here are some key points regarding this transition and its potential impact on the economy:

Previous changes in central bank leadership have seen fluctuations in economic policies. However, this time, there appears to be no reversal of the current approach.

Under Erkan’s tenure, interest rates were raised significantly, going from 8.5% in June to 45% by late January. Foreign investors, who had previously turned away from Turkey, welcomed these rate hikes.

Despite these efforts, inflation remains stubbornly high, reaching 64.86% in January 2024 compared to the previous year.

As the new Governor, Fatih Karahan is expected to continue overseeing higher interest rates, in line with Finance Minister Mehmet Simsek’s approach.

This continuity suggests that Turkey will maintain its efforts to combat inflation through orthodox economic policies. The high inflation and substantial devaluation of the Lira hinder the import of bananas destined for the Turkish domestic market.

In summary, while leadership changes at the CBRT have been frequent, the current shift does not signal a departure from the ongoing efforts to stabilize the economy and manage inflation. The challenges remain, but the commitment to maintaining higher interest rates persists.

The Iranian domestic market prices were around 65.000-75.000 Toman per kg for Ecuadorian bananas, 50.000-60.000 Toman per kg for Indian bananas and between 40.000 and 55.000 Toman for bananas from the Philippines. The price for the 13.50 kg box of Indian bananas shipped to Bandar Abbas was around USD 9.00-9.15 per box CIF.

Prices for Indian bananas in Iran are expected to increase after Indian traders started shipping bananas to Russia due to the partial ban on importing Ecuadorian bananas in Russia.

The exchange rate was 1 USD=55.000-58.000 Toman.

The highest prices in the Ecuadorian Spot Market were around USD 7.00 per box for the fruit only during the week.

Volumes of fruit increased considerably in the last two weeks and are expected to stay high shortly. The decrease in the number of boxes shipped to the Middle East was part of the higher volumes of fruit available in the spot market. At the same time, the need to be clarified imposed on exports of five Ecuadorian companies is not yet clear.

A vessel of about 526.000 cbft. capacity was fixed to perform a banana voyage from Ecuador to Algeria. One more vessel, which had been waiting in Panama since January 30 and crossed the Canal on February 8, was reported to load cargo squids in the Falklands for destinations in the Far East. Some more vessels fixed fish cargoes.

The Time Charter remained at the same levels of US Cents 75-80 per cbft the previous week. Per month for large ships and around US Cents 65-75 per cbft. Per month for smaller vessels.

Some small- to medium-sized ships were still reported idle, awaiting cargo.

Bunker Price:

VLSFO MGO

Gibraltar 611.00 908.00

Rotterdam 569.50 804.00

Panama Canal 582.00 1051.00