Market Overview – week 08/2023

2023-02-24

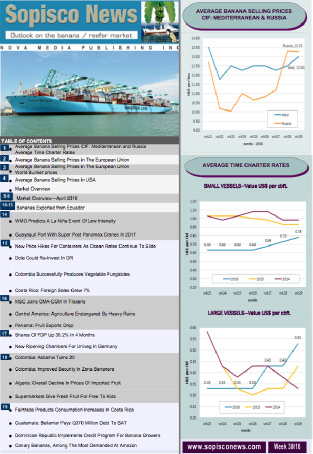

Banana selling prices in St Petersburg were around USD 23.95-24.60 per box CIF according to brand, quality, and volume. Demand was good and nearly 1.75 million boxes were discharged in week eight, and around 2.2 million are expected for week 9. The exchange rate USD/RUB was 1 USD=74.71 Ruble.

Prices in the Mediterranean were USD 17.00-19.00 per box CIF for Ecuadorian bananas according to region, volume, brand, and weight of the box.

The highest prices were paid in Libya, where the box of Ecuadorian bananas of 19.5 kg. was sold at around USD 19.00-20.00 CIF, while bananas from Central America were traded at around USD 17.00-18.00 per box CIF.

Prices in Algeria were atypical due to the lack of import licenses, and volumes were consequently minimal. Local traders are confident the Government might issue import licenses for the incoming Ramadan, which starts on the evening of Wednesday, March 22. It will end at sundown on Thursday, April 20. If the long-awaited import licenses are not issued by the incoming week, bananas might not arrive on time to be ripened and supplied to the retail system.

Prices in the Mersin Free Zone ranged from around USD 17.00-17.50 per box for re-exported bananas from Central America to around USD 20.00 per box for the fruit from Ecuador and also according to brand, quality, and weight of the box. Prices were lower as sales were affected by the consequences of the earthquake, which caused considerable losses and over 40.000 deaths in Turkey and Syria, as well as by the appreciation of the USD in Turkey and Iran, making the purchase of imported goods more expensive.

The exchange rate between the USD and the Turkish Lira was 1 USD=18.87 TL.

Compared to the previous two weeks, prices for Ecuadorian bananas in the Iranian domestic market were lower, dropping from 63,000 Toman/ kg to 57,000 Toman per kg.

One of the main reasons is the reduced spending of consumers due to the local currency devaluation against the USD and the slowing down of banana consumption close to the start of the Iranian New Year, typical for this period of the year. The price for good quality Indian bananas was around USD 12.50-13.00 per box CIF in Bandar Abbas.

Banana prices in India were high due to limited volumes of good quality fruit and strong demand in the domestic market. The cost of Indian bananas shipped to Iran depends significantly on the Ocean Freight rates, which increased from USD 1,900 to USD 4,800 per FEU to Bandar Abbas.

The USD went in the past 15 days from around 390.000 IRR or 39.000 Toman to IRR 550.000 or 55.000 Toman, thus making imports more expensive.

Prices in the Ecuadorian Spot Market ranged from around USD 8.00 to USD 10.00 per box during the week, only for the fruit but were mostly at around USD 9.50-10.00 per box according to the quality, volumes, and destination. If the Algerian government releases banana import licenses for the Northern African country, Ecuadorian Spot Market prices might increase due to the added requirements. The volumes of good quality fruit in most farms were still reduced, and the bagging was low. Industry sources said more bananas are expected for around weeks 10-12.

No banana fixtures were put on record during the week. In the last two weeks, more vessels have been taken on Time Charter from operators to add to their fleet and from other Owners or Operators to be employed in the grape or citrus trade.

The current market is around US Cents 140-150 per cbft for larger vessels, although no fixtures were reported, and around US Cents 120-130 per cbft per month for smaller ships.

Bunker prices:

VLSFO MGO

Gibraltar $ 603.00 $ 878.00

Rotterdam $ 556.50 $ 765.00

Panama Canal $ 640.00 $ 893.00